White label products are popular with banks undergoing digital transformation as well as fin tech startups seeking cost-effective solutions. Solaris Bank, for example, combines a bank license with modular banking software to offer an end-to-end experience. Trends in White Label Core Banking Software.

With a ready banking platform, financial providers are spared from spending years building a core banking tech stack from scratch. They also save money on acquiring an acquirer or payment institution licence as they can get everything from their Baas partner.

The Rise of Fin tech

Fin tech is reshaping the financial industry by providing consumers with innovative solutions to meet their needs. These solutions range from payment systems to alternative data based credit scoring and lending platforms. Trends in White Label Core Banking Software

However, building a new technology infrastructure from scratch is costly and time-consuming. This is why many new banks and snowbanks turn to white label solutions to build their products.

These solutions are already compliant with strict security and compliance regulations like KC / KY, AM (Anti-Money Laundering), and transaction monitoring. They are also ready to support a large number of users and transactions.

Moreover, they are also easy to customize and deploy. Whether your company is looking to build a mortgage app or offer an end-to-end solution for business banking, a reliable white label software development partner can help you deliver a high-performance and user-friendly product. They will take your company’s brand and vision into account to create a fully-branded product that meets all of your customers’ needs.

The Impact of Big Data

The financial services industry is awash in data, but making use of it to gain insights into customer behavior and preferences is often challenging. Big data analytics can help banks get a better understanding of their customers’ needs and wants, which will allow them to offer more products and services that are tailored to each individual.

Rather than having to build the entire infrastructure of their digital banking platforms from scratch, companies can launch new services more quickly by leveraging white label solutions. These come ready-made, allowing the company to customize it according to their own branding and look.

In essence, a white label solution is a bucket of white paint that allows other businesses to re brand it and make their own mark on it. Many of the fin tech snowbanks that have emerged in recent years, such as N26, Chime and Revolt, use this model. To minimize upfront costs, vendors usually offer between 200 and 400 hours of free customization, after which they start charging at a set hourly rate.

The Impact of Mobile

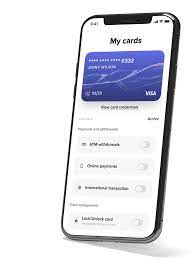

White labeling is a great way to reduce costs for digital financial platforms. It saves time in development and allows a fast launch of products without having to build an entire payment infrastructure from scratch. Additionally, a trusted supplier will take care of security regulations and the certification process. They can also help with compliance issues depending on the regions that your customers are in.

Using a banking-as-a-service (Baas) approach can also speed up the development of a platform. BaaS is essentially an unbranded software that the reseller can integrate with their branding, and then sell access to it as their own product.

Regulated banks occupy the bottom layer of a Baas stack, handling the licensing and legal obstacles. Fin tech service providers occupy the middle layer, and brands occupy the top of the stack, controlling things like user experience and the design of digital experiences. This model also helps to cut out the cost of building new infrastructure by making it easier for businesses to use existing infrastructure.

The Impact of Artificial Intelligence

The rise of Fin tech has revolutionized the way people manage their money. However, the technology has also introduced new challenges for financial institutions as they work to integrate these software solutions into their digital infrastructures.

To meet customer demands, banks must deliver fast processing in real time, ensure frequent feature releases, flex up and down their infrastructure on demand and maintain compliance with regulations. To accomplish these goals, many financial services companies are turning to white label core banking software.

With a white label solution, businesses can develop top-tier solutions much more quickly and easily than by developing them from scratch. They can use an existing payment infrastructure and core banking backed as well as benefit from the security and expertise of a trusted Baas provider. This helps to lower the cost of development, reduce risks and increase user loyalty. It’s important to choose the right white label Fin tech solution and Baas partner, however, as the wrong choice can lead to catastrophic issues for a project needs read more hear.